1、 Build trading platform

Building the service front end or transaction platform of online banking e-commerce is the primary content of online banking e-commerce. It includes establishing and developing online special customer groups, carrying out social intermediary business of government or enterprises, undertaking basic financial services of special merchants or related enterprises (such as payroll), and providing service support for related auxiliary enterprises. There are three options for online banking to build a service platform for customers: first, online banking itself provides customers with a virtual trading platform on which customers can trade; Second, online banking only provides customers with link services with special merchants or other trading partners; The third is to provide both a real-time trading platform and link services.

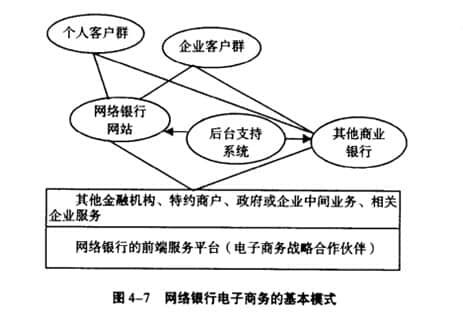

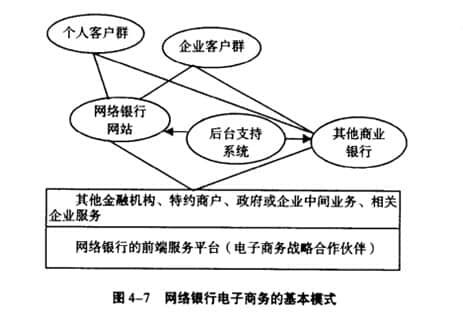

As can be seen from Figure 4-7, the basic requirement for the success of online banking e-commerce strategy is that the service front end should be particularly "thick". Here, "thick" means not only having a large distribution. Franchised merchants in all walks of life also mean that their businesses or commercial activities are of high quality, giving customers a sense of high-quality business groups. Once customers become customers of online banking, they should feel as if they have joined a high-end club, and this feeling comes from their recognition of the quality of online banking service front-end. This is one of the effective strategies in online banking e-commerce marketing.

2、 Build inter-bank payment and transfer platform

If a consumer has consumed a service in a special merchant linked to A on the commercial bank website where he does not have an account, can he send instructions through this online banking website to transfer the funds in his account in bank B to the account opened by the special merchant in bank A? At present, I'm afraid it can't be realized, because the online banks of different commercial banks haven't really realized universal deposit and withdrawal, so they can't provide customers with this seemingly simple basic service. However, a relatively complete online banking e-commerce activity must be able to provide customers with such basic services.

3、 Select strategic partners

The financial e-commerce strategic partners of commercial banks include all other non bank financial institutions, such as insurance companies, securities companies, futures companies, fund management companies, financial companies or investment companies. The primary purpose for commercial banks to form strategic alliances with other financial companies is to extend and expand their service distribution network and customer base through cooperation with insurance companies, securities dealers, etc. If this strategic goal cannot be well achieved, cooperation matters should be postponed or acted carefully. Secondly, the principle of cooperation between banks and insurance companies, securities dealers, etc. is to obtain mutual utilization of distribution networks and customer resources, which is conducive to the expansion of business between both parties. Otherwise, the strategic significance of cooperation will not be obvious.