In people's impression, the symbol of online banking is that the commercial bank has opened a commercial website. This illusion comes from the enthusiasm of some commercial banks to open websites. However, after the website was opened, there was no special fund or personnel responsible for the development and operation of the website, leading to the outdated or long-term unchanged information content of the bank website. Another common and wrong strategic idea is that the planning and production of commercial websites are more important than the strategic planning of online banks. It seems that there are websites with friendly interfaces and fresh columns. Coupled with the so-called "attention" advertising campaign, they create the scientific and technological image of commercial banks. Although it is impossible not to have Website construction However, the website construction should serve the network bank, and the network bank strategy should not be regarded as the supplement or embellishment of the website service column design. Browsing the homepage of Internet banks in developed countries, we can find that the websites of commercial banks in developed countries generally consist of four parts, namely bank introduction, public information, personal banks and corporate banks. The high convergence of website structure and content is a microcosm of the highly convergent development of internet banking services in developed countries. It can be seen that the strategic competition focus of internet banking is not on the form of websites, but on the support of backstage services.

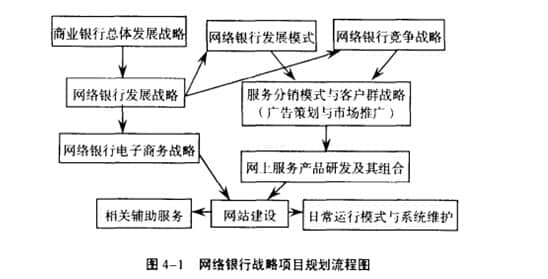

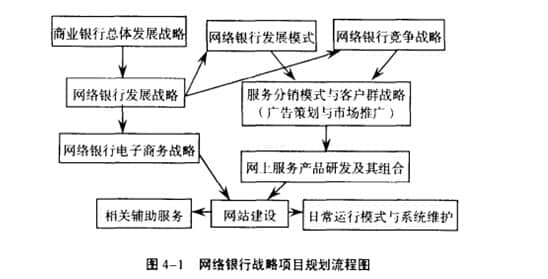

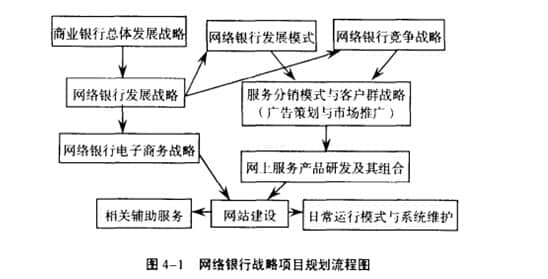

In the network bank project planning, the overall development strategy of the commercial bank must be determined first, which is the basis and premise of all contents in the project planning. Only on this basis can we finally determine the development strategy of online banking. After determining the development strategy of online banking, the customer group strategy, service distribution strategy and e-commerce strategy of online banking will be determined based on the strategy, and finally the product design and business portfolio strategy will be determined. See Figure 4-1 for the operation contents and procedures of the strategic project planning of online banking. Generally, only after the product design and business portfolio are determined, can other relevant auxiliary services, such as technical support (outsourcing or independent development) and human resource management, be determined, and finally determine the daily operation management mode and system maintenance mode of online banking, then the total cost and average unit cost of maintaining the continuous operation of online banking projects can be roughly estimated, Then it estimates the investment structure and return of internet banking, and finally forms the research on the investment risk and control of internet banking, thus completing all procedures of the strategic project planning of internet banking.

Based on the above analysis, it can be concluded that: a relatively complete strategic project planning of online banking mainly includes the following eight contents: (1) research and formulation of the overall development strategy of commercial banks related to the development of online banking; (2) Strategic development model of internet banking; (3) The competitive strategy of online banking further subdivides the distribution mode and customer group strategy of online banking; (4) The research and development strategy of online banking service products further subdivides the service product portfolio marketing strategy; (5) E-commerce strategy of internet banking; Further subdivide e-commerce partner strategy; (6) Web site design and strategic model of online banking; (7) Online banking related auxiliary service mode, daily operation management mode and system maintenance mode; (8) Investment structure, project risk analysis and control of internet banking. Network bank strategic project planning is one of the most complex topics in all e-commerce project planning. It needs to be one of the two major problems in current e-commerce: payment and security. Propose corresponding solutions from the perspective of management consulting.