The biggest differences and characteristics between the NASDAQ stock market and the traditional stock exchange are as follows.

1、 Market maker system

The so-called market maker means that any company listed on NASDAQ must have several competing securities dealers to preside over the trading of its shares on the market. The market maker continuously makes two-way quotes on one or more of its registered stocks, and as the counterparty of the transaction, it conducts transactions with brokers or dealers at any time, but the market maker does not engage in proprietary trading on its registered stocks.

2、 Electronic trading service system

The other characteristic of the NASDAQ market, different from other stock exchanges, is that there is no securities trading hall, but an empty electronic market. This market has set up a large number of computer sales terminals around the world to transmit comprehensive quotations and latest trading information of various securities to traders, fund managers and brokers in all corners of the world. These terminals cannot be directly used for securities trading, nor can they make market for stocks in the NASDAQ market, nor can they accept orders. If securities brokers or dealers outside the United States want to trade, they generally need to obtain NASDAQ market information through computer sales terminals, and then notify the member companies of the National Association of Securities Dealers in the United States by telephone.

3、 Electronic transaction

In essence, the NASDAQ securities market is a star shaped terminal network system. Traders buy and sell securities by themselves through electronic terminal workstations, and win orders from investors through active competition. That is, every market maker of a certain securities transaction must quote an "effective" bid price and offer price. The bid price is the price that the market maker is willing to buy, and the offer price is the price that the market maker is willing to sell. Market makers should be ready to trade according to their respective prices published on the NASDAQ securities market at any time. This electronic trading has changed the trading mode of the traditional securities market, thus realizing the following major functions.

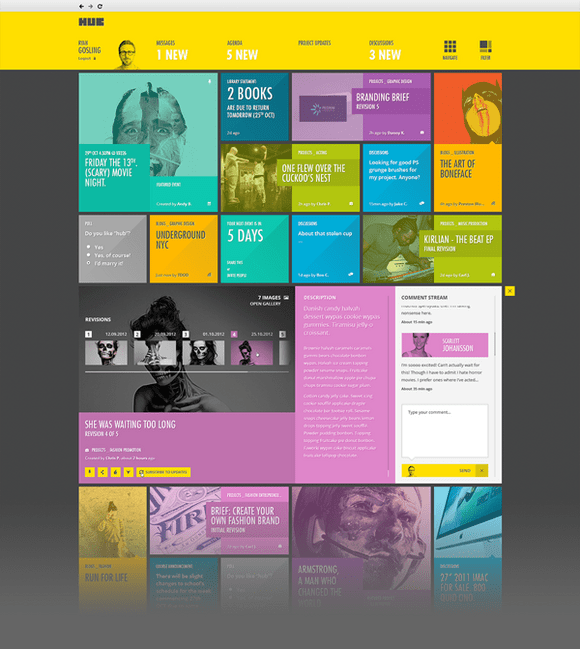

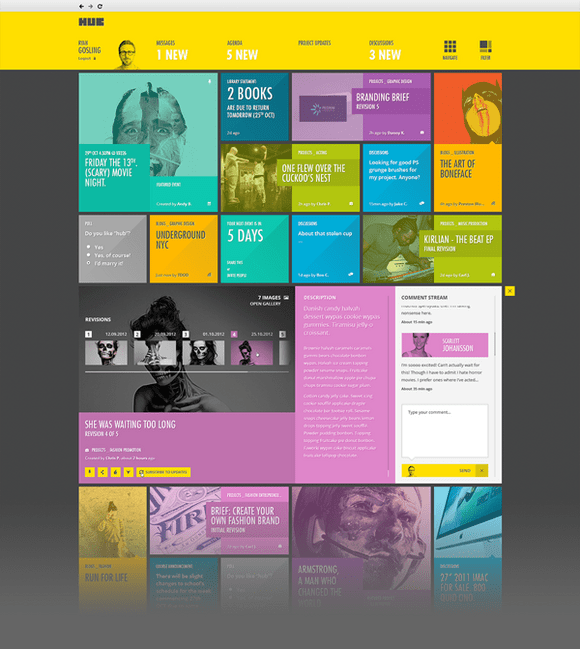

First, electronic informatization of securities trading, that is, securities certificates for listed transactions pass Website Design The price has realized electronic data, and the transaction process and processing have realized computer processing automation. Second, electronic trading eliminates the geographical difference, time difference and information difference caused by different regions and distances, so as to ensure that investors can get the best price for buying and selling. Third, the continuity of trading activities. In the traditional trading activities of the securities market, the trading activities are often stopped for various reasons. After the electronic trading is realized, the computer realizes the continuous operation of quotation, commission, transaction and clearing within the specified time, making the securities trading activities continue. Fourth, the openness and transparency of securities trading. In the process of automatic trading, the trading and sales departments of market makers regularly track and analyze the securities they buy and sell. Brokers and investors around the world can see the quotations of NASDAQ market makers through the terminals of NASDAQ securities trading information, and can also grasp the prices of transactions and deliveries through feedback information, increasing the transparency of market transactions, It not only avoids the limitations brought by the time difference of different places, but also prevents the illegal behavior of the black box operation. Make the transaction behavior of dealers and brokers around the country fair, just, open and reasonable.

The electronic securities trading system of NASDAQ realizes the digitization of securities certificates. At the same time, the cost of its management and operation has been greatly reduced, and the interests of listed companies and investors have been protected to a great extent.